© National Craft Butchers 2022 – Registered in England (Company No. 00067142) 1 Belgrove, TN1 1YW – VAT 445792223

© National Craft Butchers 2022

This year, the NCB wage survey received over 160 responses from England and Wales. We appreciate everyone who took a few minutes to complete our survey.

We’re sharing the highlights with you here, but our Full members can find more details and breakdowns for regions and type of location in the Employment section of our Members area.

We know that while Salary is obviously important to potential and current employees it is also important to consider the entire employment package. This should include looking at how competitive your pension, sick pay, holiday, and other benefits are. You may already be offering more than you think and when advertising a position in your business think about advertising benefits such as Free Lunch or Employee discount. Employee benefits increase the value of working for a certain company and can improve your or your team members’ health and quality of life[1].

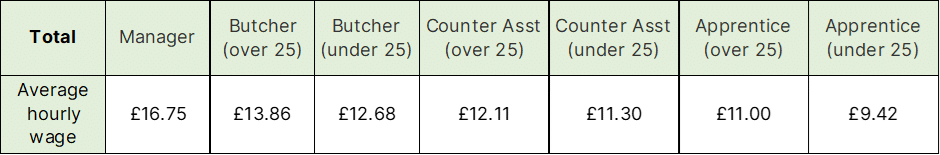

The total average hourly wage based on responses are as below:

On average hourly wage across all job roles listed, pay has increased by 7.8% from last years survey.

Workplace Pension:

Offering a workplace pension has been a legal requirement for all businesses for several years. According to the survey, 98% of respondents are providing the minimum employer contribution of 3%. However, 2% of employers are going above and beyond by offering enhanced pension contributions of 5%. The average employer contribution across the UK stands at 4.5%[3].

Annual Leave:

All employees are entitled to 5.6 weeks of holiday (which includes 20 days plus 8 bank holidays, pro rata for part-time employees). Interestingly, 9% of respondents are offering staff more than the standard entitlement, either as part of long-term service recognition (an additional day per year up to 5 years), birthday entitlement or as a standard benefit. This is an increase of 2% compared to last year’s survey.

A recent survey by MetLife revealed that 40% of employees would be willing to sacrifice pay for personalised benefits, 35% look for generous pension contributions and two-thirds of employers are actively reviewing their benefits packages[4].

Sick Pay:

While there is no legal entitlement to sick pay beyond Statutory Sick Pay (SSP), 27% of respondents are offering discretionary company sick pay. This is an increase of 2% from last year’s survey. This benefit is often tied to an employee’s length of service, with staff accruing more sick pay the longer they stay with the company. According to the TUC, sick pay is highly valued and a robust sick pay system is essential[5].

Other Benefits:

Employee benefits play a crucial role in attracting and retaining talent. Small businesses can enhance their offerings beyond salary by considering benefits such as:

These benefits are accessible to small businesses and can significantly impact engagement levels, productivity, and overall company performance. Here are some other employment benefits being offered by respondents:

Remember, being competitive as an employer goes beyond just salary. A comprehensive benefits package can make a significant difference in attracting and retaining top talent.

[1] Why Are Employee Benefits Important? Types and Advantages | Indeed.com

[2] Creating a competitive employee benefits package | Workspace ®

[3] How generous is your employer | Life Hacks| Profile Pensions

[4] Two in five UK employees would take a willing pay cut for better benefits (metlife.co.uk)